The mandatory use of electronic invoices (e-invoices) generated by cash registers marks a significant step in the Government’s ongoing efforts to modernise tax management and ensure greater fairness and transparency in fulfilling tax obligations.

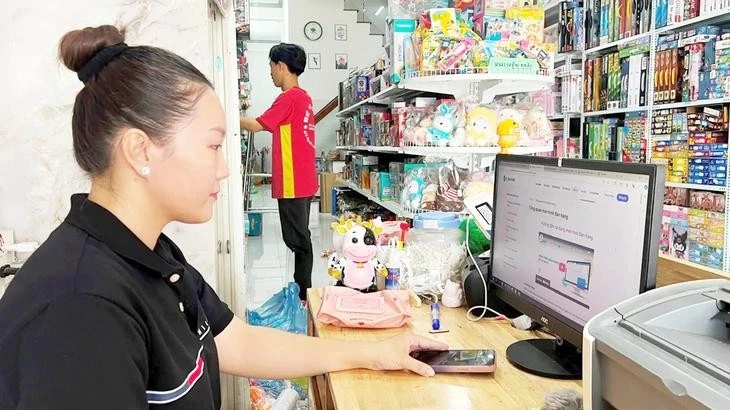

Starting June 1, 2025, the use of electronic invoices (e-invoices) generated by cash registers has officially become mandatory for business households with annual revenue exceeding 1 billion VND (approximately 38,361 USD).

This move marks a significant step in the Government’s ongoing efforts to modernise tax management and ensure greater fairness and transparency in fulfilling tax obligations.

From the first days of implementation, the majority of business households have proactively cooperated with tax authorities to familiarise themselves with the new system, with assistance provided by local tax officials.

Nguyen Thi Trang, owner of a fashion shop in Hanoi’s Tay Ho district, said she received enthusiastic support from tax officials. However, she noted that the costs of installing software and purchasing the necessary equipment pose challenges for many businesses.

Trang found the initial procedures quite complex. Given how time-consuming daily business operations already are, many merchants are unable to handle the new procedures on their own and must rely on tax assistance services. Tax officials also require daily reports on implementation progress, which significantly increases the workload, she added.

Dang Van Quoc, a small trader near An Dong market in Ho Chi Minh City, said he remains confused despite receiving advice from tax officials. He has purchased a printer, scanner, and software. However, as he doesn’t know how to use them properly. As a result, the man is considering seeking support from the tax authorities to avoid potential penalties for data errors.

It is noteworthy that many business owners in HCM City have actively participated in training sessions organised by the tax department or are using outsourced accounting services to ensure compliance. Nevertheless, most of them hope for a clear implementation roadmap and a reasonable timeframe to adapt to the new requirements.

In response, the Tax Authority has instructed regional tax departments to establish steering committees to oversee the implementation of e-invoices from cash registers. These committees are responsible for monitoring daily progress, identifying challenges faced by businesses on the ground, and ensuring compliance with current legislation.

Tax officials have also been directed to support affected business households even during public holidays, in order to promptly resolve issues related to e-invoice issuance and to facilitate a smooth transition under the new regulations./.

VNA