Many banks have established green transition steering committees, embedded the ESG criteria in their business strategies, and expanded funding for environmentally-friendly sectors.

The banking sector has stepped into a leading role, opening financial pathways to help with the green transition. At the forefront is the Vietnam Bank for Agriculture and Rural Development (Agribank), which recently launched a preferential credit package worth 50 trillion VND (1.92 billion USD), effective from April 2025.

The short-term loan programme offers an annual interest of 4.5%, or 0.3–0.5 percentage point lower than standard market rates. The initiative targets individual customers engaging in agricultural production, with priorities given to environmentally conscious and tech-driven farming models.

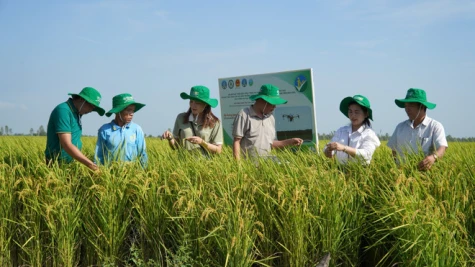

Other commercial banks like Nam A Bank, HD Bank, and Bac A Bank have jumped into the bandwagon, embracing green finance as their strategic pathway. Nam A Bank, for instance, is not only offering concessional loans for high-quality rice production in the Mekong Delta but also financing projects using solar power, water-saving irrigation, and low-emission farming technologies, according to Deputy Director of the bank’s northern region Dao Duy Nam.

Nam A Bank's commitment extends beyond financial support to digital transformation through its Open Banking ecosystem, enabling farmers to access financial services anytime and anywhere. The bank has actively created value chains connecting farmers, enterprises, banks, and markets across such sectors as tea, rubber, and aquaculture, thereby enhancing investment efficiency and increasing agricultural product value.

Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu held that as green growth is no longer an option but an inevitable requirement for developing countries like Vietnam, the central bank has integrated sustainable development goals into the credit strategy since 2015 while continuously completing mechanisms and policies to promote green credit throughout the banking system.

These efforts culminated in the SBV's 2023 rollout of the action plan for implementing the National Green Growth Strategy for 2021–2030. Nearly two years into the initiative, Vietnamese credit institutions are showing a remarkable shift in their awareness. Many have established green transition steering committees, embedded the ESG (Environmental, Social, and Governance) criteria in their business strategies, and expanded funding for environmentally-friendly sectors.

Bridging gaps in green financing

Despite expansion, green credit in agriculture still faces bottlenecks. Tu said the implementation of green credit remains uneven, with some financial institutions yet to report any outstanding green loans, which is largely due to the absence of a standardised green taxonomy.

He described limitations in environmental – social risk evaluation tools as a big hurdle. He explained that green projects typically require longer payback periods with unclear financial returns, making many credit institutions reluctant. Besides, the capacity to mobilise international resources for green finance remains ineffective due to inadequate coordination and information sharing mechanisms.

Looking ahead, the Deputy Governor said it is necessary for the banking sector to improve governance capacity and staff’s professional expertise, especially regarding environmental, social, and climate criteria.

Recently, the central bank published a handbook on environmental and social management system to support credit institutions to identify and control ESG risks in credit supply, gradually approaching international standards and improving green capital quality, particularly in agriculture.

Assoc. Prof. Dr Tran Van Dung, Deputy Director of the institute for economic – financial research and training, proposed the establishment of a sustainable agriculture supporting fund to sponsor green-tech projects, climate-resilience farming, and low-emission production models.

Furthermore, expanding microcredit through bank cooperation with fintech organisations and microfinance institutions will help smallholders and cooperatives access capital more easily, transparently, and flexibly.

Another essential factor Dung mentioned is developing agricultural insurance and credit guarantee mechanisms, helping farmers minimise risks when borrowing while encouraging banks to lend more confidently in the green space./.

VNA